Commercial Leases

It's important to get your commercial lease in order.

It is imperative that with any lease the details are comprehensive and correct and commercial leases are no exception whether you are the landlord or the tenant.

The starting process is to agree the terms of the lease and this is usually done via a commercial agent but the parties should seek the advice of a solicitor if unsure.

The key areas are usually the length of the lease, rent (and whether or not VAT is paid on the rent – this in turn may impact on any stamp duty land tax payable by the tenant on the lease (if any), rent review dates and the basis of rent review, service charges, repairs, permitted use, whether the lease allows for alterations or assignments (transferring the tenant’s interest) and if, when and how the lease can be brought to an end.

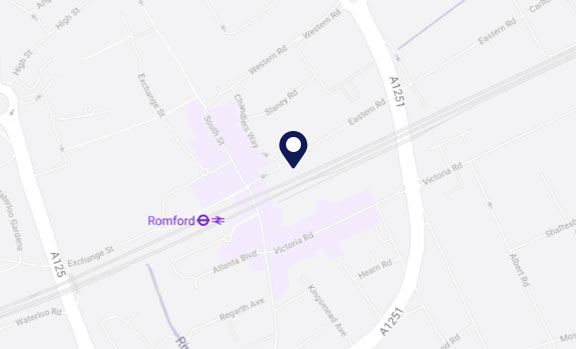

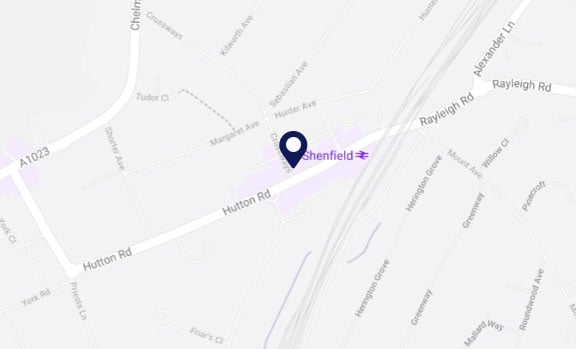

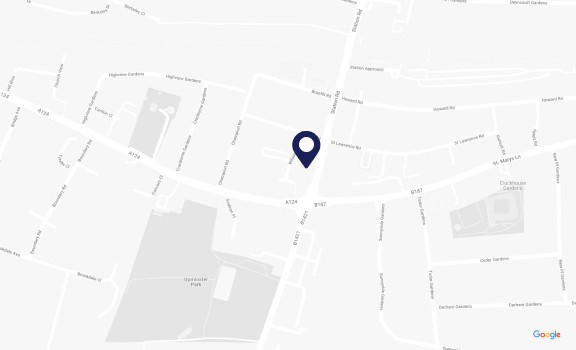

Services also offered in

Landlords will often also want security for the lease, especially if the lease is being granted to a limited company. This is usually in the form of a rent deposit (a sum of money usually equivalent to 3 or 6 months which is retained by the landlord for the duration of the lease but which can be drawn upon in the event of the tenant’s default).

The parties may also require a break provision which enables one or both to terminate the lease early in certain circumstances. A landlord may require this for development purposes, for example, and a tenant may require this if they are starting a new venture and require the flexibility of an exit without either having to find a buyer for the lease or continuing liability under the lease.

The parties should also consider security of tenure rights. The Landlord and Tenant Act 1954 provides business tenants occupying premises for the purpose of their business with security of tenure rights. In essence, this means that such business tenants can simply remain in the premises at the end of the lease term and hold over on the same terms as the lease or alternatively, the tenant is entitled to seek a new lease of the premises on substantially the same terms as the current lease.

The landlord does have grounds to end the lease at the expiry of the lease term or to refuse the grant of a new lease but these grounds are limited and are set out in statute.

The parties also need to consider the position at expiry of the lease. Most commercial leases are fully repairing which means that the tenant must put and keep the property in good repair and return it to the landlord in a good state of repair and condition. This can be a substantial obligation on the tenant and potentially expensive and as such, tenants often seek to limit their liability in this regard.

Whilst leases may be varied at a later date this can only be with the consent of both parties and it must be by formal deed. It is therefore essential that the lease be correctly drafted in the first place having considered all pertinent issues.

Commercial Property Enquiry

Fill out the form and a member of our team will get in touch to discuss how we can help.

Mullis & Peake will use the information you provide in this form in accordance with our privacy policy. With your consent, we may from time to time send you general updates by email or post that we think you will find of interest.This includes notification of upcoming event and updates or alerts containing relevant legal news. You can update your preferences at any time and will be able to easily unsubscribe from anything that you do not wish to receive.

Frequently asked questions

The options available to you will depend upon the contents of your lease but there are four main methods. The first method would be to exercise your break clause if you have one. The second method would be to try to reach an agreement with your landlord to allow you to surrender your lease early. However, they are under no obligation to do this, and you may be required to pay a premium in exchange for early surrender. The third method would be to assign or transfer your lease to a third party usually this requires the priority and consent of your landlord. The fourth method would be to sublet your property to your own tenant. Again, usually this requires prior consent. There are pros and cons to each method and the best thing you can do is seek advice from a solicitor to confirm which methods are available to you.

The first thing to check is what are the dates in your break clause, when is your break date and how much notice do you need to give in advance. The second thing to check is the method of service, how do you need to serve that notice on your landlord. The third thing to check is, are there any conditions attached to the break, do you need to make any payments to the landlord, do you need to give vacant possession on the break date. There are likely to be a number of conditions which need to be satisfied so it's important to seek legal advice well in advance before seeking to exercise your break.

When entering a new lease there are certain things that you need to consider when agreeing the lease terms. The first thing is the length of the lease, is the term of the lease suitable for you. You also need to consider the rent that's payable, whether VAT is payable on the rent and any rent reviews. You may also be asked to pay a rent deposit to the landlord as security throughout the lease term. You need to consider the permitted use of the lease, are you able to use the premises for your business. You need to consider service charge payments, are they affordable, are they reasonable, and repair. What are your repair obligations under the lease, quite often commercial premises are fully repairing and that's quite an onerous obligation on a tenant. Sometimes you may also wish to consider whether you can get out of the lease early, is there a break provision. If not, can you sell the lease or can you under let it to somebody else.

A mechanism in the lease by which the rent as the name suggests is reviewed. Rent is usually reviewed on an upwards only basis which means that if no increase is agreed on review, then the rent will remain the same. Rent can be reviewed by reference to market rent, turnover rent, index link, or sometimes a combination of all of them. There is a trend towards trying to get downward rent reviews although most landlords are resistant to that because it could have an adverse effect on the property value.

Sections 24 to 28 of the landlord and tenant act, 1954, provide business tenants occupying premises for the purpose of their business with security of tenure rights. This essentially means that such tenants can simply hold over or remain in the premises at the end of their lease term, or they can seek a new lease from their landlord on substantially the same terms as the existing lease. There are exceptions, a landlord can refuse to grant a new lease to a tenant on one or more of the seven statutory grounds for a refusal and they include the tenant's persistent non-payment of rent, or breach of other terms of the lease, or most commonly the landlord wanting to occupy the premises themselves or wishing to demolish the premises.

Mullis & Peake have solicitors specialising in commercial property ready to help you. Contact us online today or call us on 01708 784000.

Alternatively, request a call back to have one of our experts contact you at a time that suits.