Power Of Attorney

What is a Lasting Power of Attorney?

A Lasting Power of Attorney (LPA) is a document that allows you to appoint one or more people (known as attorneys) to help you make decisions, or make decisions on your behalf.

The LPA can cover financial and property matters or health and welfare issues. It can be important if you are unable to manage these matters as you get older, or if you become ill.

There are a number of reasons why you might need someone to make decisions for you or act on your behalf:

- This could just be a temporary situation: for example, if you're in hospital and need help with everyday tasks such as paying bills.

- You’re finding it harder to get out and about to the bank or post office, or you want someone to be able to access your account for you

- You may need to make longer-term plans if, for example, you have been diagnosed with dementia and you may lose the mental capacity to make your own decisions in the future.

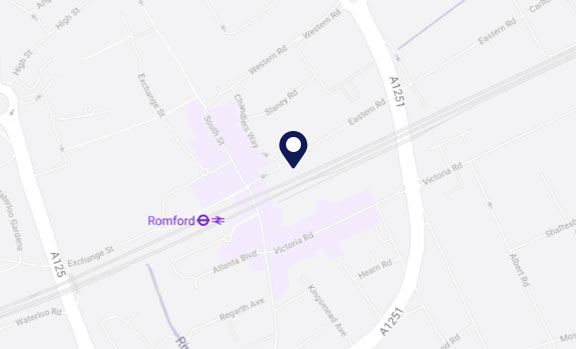

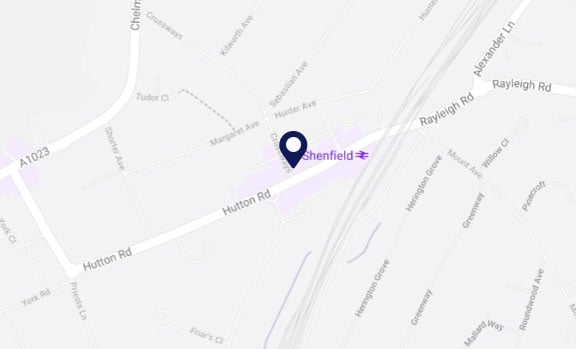

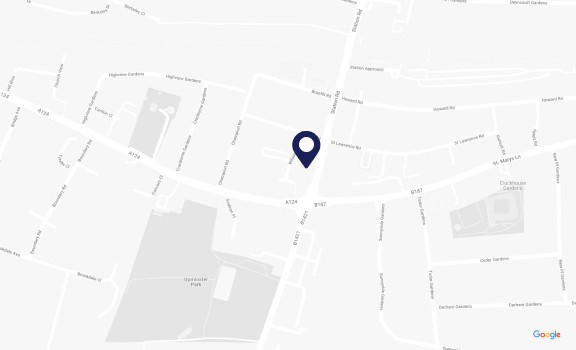

Services also offered in

What is Mental Capacity?

Mental capacity means the ability to make or communicate specific decisions at the time they need to be made. To have mental capacity you must understand the decision you need to make, why you need to make it, and the likely outcome of your decision.

What are the Different Types of Power of Attorney?

LPA for Financial Decisions

Ordinary power of attorney

This covers decisions about your financial affairs and is valid while you have mental capacity. It is suitable if you need cover for a temporary period (hospital stay or holiday) or if you find it hard to get out, or you want someone to act for you.

Lasting power of attorney (LPA)

An LPA covers decisions about your financial affairs, or your health and care. It comes into effect if you lose mental capacity, or if you no longer want to make decisions for yourself. You would set up an LPA if you want to make sure you're covered in the future.

Enduring power of attorney (EPA)

EPAs were replaced by LPAs in October 2007. However, if you made and signed an EPA before 1 October 2007, it should still be valid. An EPA covers decisions about your property and financial affairs, and it comes into effect if you lose mental capacity, or if you want someone to act on your behalf.

An LPA for financial decisions can be used while you still have mental capacity or you can state that you only want it to come into force if you lose capacity.

An LPA for financial decisions can include things such as:

- Paying bills

- Buying and selling property

- Paying the mortgage

- Investing money

- Arranging repairs to property.

You can restrict the types of decisions your attorney can make, or let them make all decisions on your behalf.

LPA for Health and Care Decisions

This covers health and care decisions and can only be used once you have lost mental capacity. An attorney can generally make decisions about things such as:

- Your medical care

- Where you should live

- What you should eat

- Who you should have contact with

- What kind of social activities you should take part in.

You can also give special permission for your attorney to make decisions about life-saving treatment.

Most Wills and LPAs can be drafted for you at a fixed cost, which can be confirmed once we know more about your situation. Mullis & Peake LLP believe in transparency in both our work and our charges, and our team is committed to providing you with quality advice and service at all times.

Wills and Power of Attorney Enquiry

Fill out the form and a member of our team will get in touch to discuss how we can help.

Mullis & Peake will use the information you provide in this form in accordance with our privacy policy. With your consent, we may from time to time send you general updates by email or post that we think you will find of interest.This includes notification of upcoming event and updates or alerts containing relevant legal news. You can update your preferences at any time and will be able to easily unsubscribe from anything that you do not wish to receive.

Frequently asked questions

In relation to property and financial affairs lasting powers of attorney, your attorneys can act for you on your behalf to make decisions about your money and your property. Whilst the donor has capacity, all decisions are made by them, but they tell you what they need from you and how you can help them. Your attorneys will have access to your financial information, and also have the authority to take money out of your bank for the purposes of the donor. They can talk to third parties on the donor's behalf, and the attorneys can sell or purchase a property for the donor.

Under health and welfare lasting powers of attorney the attorneys can only act for the donor when they have lost the full mental capacity to make decisions about their healthcare, medical treatment, and life-sustaining treatment. The attorneys can make decisions as if the donor was able to make the decisions themselves. The attorneys can make decisions about where the donor shall live.

Two types of lasting powers of attorney. One is property and financial affairs and the other is health and welfare. In relation to property and financial affairs your attorneys can act for you when you have capacity and also when you lack capacity in relation to your property and your money. In relation to health and welfare, your attorneys can only act for you when you have lost the full mental capacity to make decisions about your Health and Welfare whilst you're in hospital and or a care home. The health and welfare also includes life-sustaining treatment which can mean anything from operations, cancer treatment, resuscitation nourishment anything that could potentially save your life. You can specify who you would like to make those decisions for you which would be either your attorneys, or the doctors.

A Lasting Power of Attorney (LPA) is a document that allows you to appoint an Attorney to assist you either with Financial and Property matters or Health and Welfare issues. This can be important if you are unable to manage these matters when you get older, become ill, or even if you are abroad for an extended period of time.

Mullis & Peake have experts in Wills and LPAs ready to help you. Contact us online today or call us on 01708 784000.

Alternatively, request a call back to have one of our experts contact you at a time that suits.