Legal

Equity Release: Pros, Cons, and Legal Considerations

Equity Release mortgages allow the over 55s to release funds from their property whilst continuing to reside there. Equity Release requires specialist legal and financial advice.

A recent report on Sky News on the 9th of May 2025 stated “The Equity Release Council have reported a 32% increase between the first quarter of 2024 and for the same period of 2025. It is the fourth successive quarter of growth recorded by this market”

Historically Equity Release mortgages received a lot of bad press, but Equity release mortgages now have a better press coverage, improved products and increasing demand. There are also a lot of advantages to them

- You can retain full ownership of your property without having to sell or downsize your property

- You can help your children and grandchildren with a deposit for a property so they can get their foot on the property ladder. The younger generation are finding it increasingly harder to purchase a property as larger deposits are required

- You can make home improvements to your property that you did not think you would be able to afford

- You can go on that dream holiday of a lifetime that you did not think you would be able to afford

- Equity release can assist in dividing up assets if you get divorced

- You can help your children/ grand children go to university

However, Equity Release mortgages are not suitable for short-term borrowing of less than five years due to high early repayment charges.

Paul Fursman, Senior Associate Solicitor in our Residential Property team, said:

“At Mullis & Peake LLP Solicitors we are seeing a growing number of instructions in Equity Release matters each year. We are current members of the Equity Release Council. We provide detailed analysis of the Equity Release offer and our service includes the following:

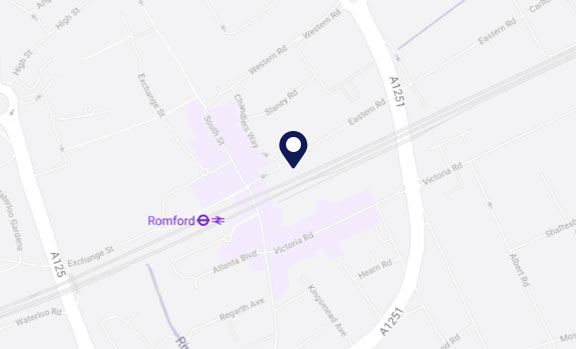

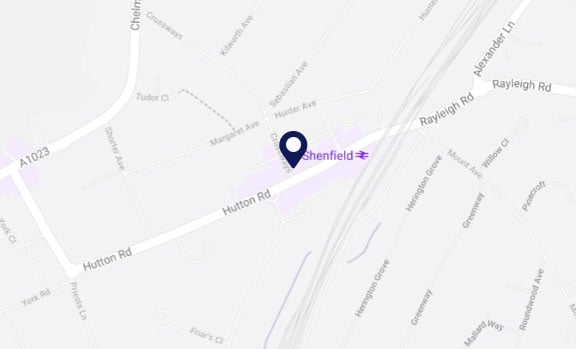

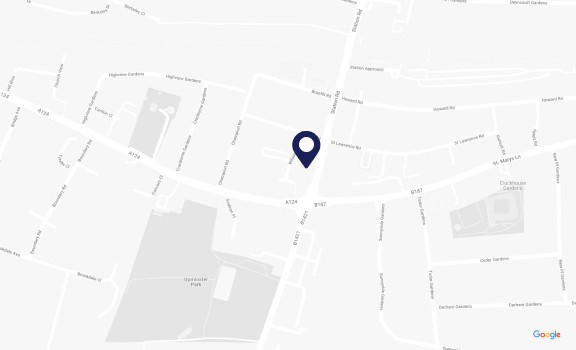

Please contact Paul Fursman on 01708 784037 if you wish to obtain advice on an Equity Release.”