Legal

Changes to Stamp Duty Land Tax

You must pay Stamp Duty Land Tax if you purchase a property or land over a certain price in England and Northern Ireland.

In 2022 the “nil rate” threshold for Stamp Duty Land Tax was raised from £125,000 to £250,000, and from £300,000 to £450,000 for first time buyers, this is due to end in March 2025. This will mean those buying a property from April 2025 will pay more in Stamp Duty Land Tax.

SDLT on second homes increased from 3% to 5% on the 31st October 2024.

The Times recently reported on data from Savills which found that the average price for new homeowners in London is £480,040, so a first-time buyer at this level would pay an additional £6,250 from 1st April 2025. The scheme will add £2,500 of SDLT to the average house purchase. There is likely be a last minute flurry of deals as thousands of pounds will be at stake.

If you are currently purchasing a property and want to benefit from the current Stamp Duty Land Tax rates you need to complete your purchase by the end of March 2025.

Paul Fursman, Senior Associate Solicitor in our Residential Property team, said:

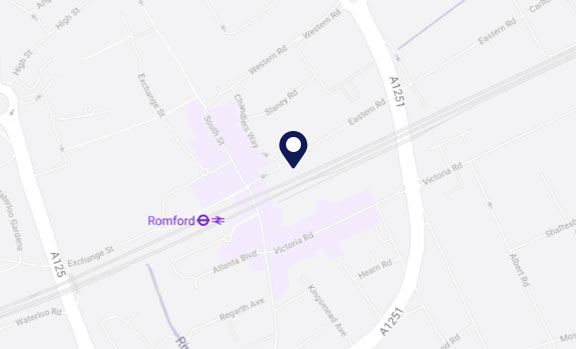

“For advice on selling or purchasing a property, please contact the Residential Property Team at our Romford office on 01708 784000. The average property transaction takes 10-12 weeks, it can be longer and can be shorter due to third parties being involved in the transaction. Time is therefore of the essence if you are purchasing a property and do not want to pay the increased rates of Stamp Duty Land Tax.”