Legal

What to do when your loved one dies

On average, around *53,000 deaths are registered every month in England and Wales (correct as of September 2023) meaning that is it likely that each of us will, at some point in our lives, deal with the administrative steps involved when someone close to us passes away.

It can difficult knowing what to do or where to start, particularly in such a distressing situation. So, we have created a handy checklist to help you navigate the steps involved, along with our top tips:

Register the death

- When someone passes away, their body must be examined by a trained medical professional to verify that the person has died. The location of the death will usually dictate who might verify the death. For example, if the individual was already a patient in hospital or nursing home, the treating doctor would likely give the confirmation. If the individual passed away at home, it might be appropriate to call their GP instead. The relevant doctor will then issue a medical certificate verifying the death.

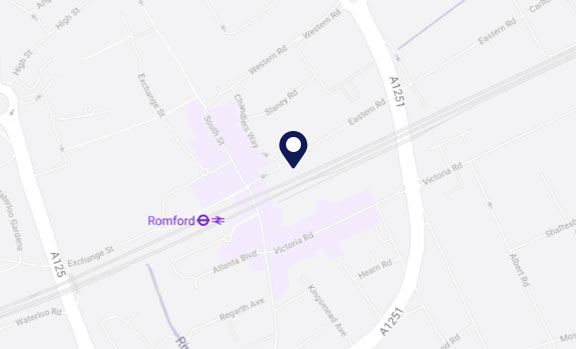

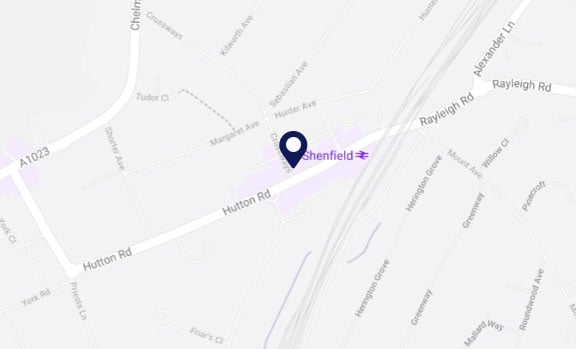

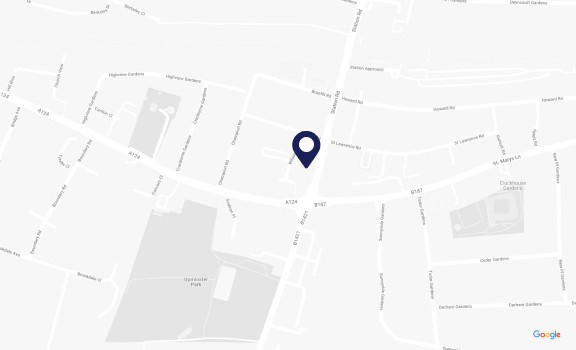

- Next you need to register the death. To do this, you will need to make an appointment at the registry office in the local authority where the death took place, not where the deceased lived. The medical professional who verified the death may send the verification form directly to the registry office, but if not, you should take it with you to the appointment.

- At the appointment to register the death, you will have the option of purchasing official copies of the death certificate. You will also be issued with a certificate for burial or cremation, also known as the ‘green form’.

- You will need to provide the green form to your chosen funeral director before they will accept instructions to arrange a funeral. Keep receipts of your expenditure as you can claim reasonable funeral costs back from the estate.

Did you know…

The death certificate issued to you by the Registry Office is not an original document. Only one original death certificate is produced and this is retained centrally by the General Register Office. Individuals are issued with an official copy, which is why they are able to order and purchase multiple copies. For this reason, it is not permissible to provide a certified copy of a death certificate, because the death certificate is not an original.

Tell Us Once

- Tell Us Once is a service that allows you to notify government organisations of a death via one report. This includes HMRC, DWP, the passport office and the local council.

- The Registry Office can assist with the Tell Us Once service by providing you with a unique reference number which you can use when making the report, either through the gov.uk or by phone.

Top tip – if the deceased owns a property, make sure the property is secure and the insurance company is notified. If the property is being left unoccupied, you might want to think about draining down the water and draining the system, or placing the heating on timer (as appropriate). Check insurance requirements as most want you to make regular inspections and visits, otherwise your cover may be void.

Apply for Probate

- After a person passes away, those responsible for managing the deceased’s affairs must make sure all debts are paid before any remaining funds and assets are distributed to the correct beneficiaries. Depending on the value of the estate, there might be inheritance tax to pay.

- In order to pay debts or distribute to beneficiaries access to the estate funds will be needed. Many banks and financial organisations will only release funds or allow assets to be transferred or sold after seeing a formal authority from the person representing the estate. This authority is commonly referred to as ‘Probate’.

- To obtain Probate you will need to first value the estate. This means contacting all organisations with whom the deceased had a financial relationship. This could be everything from the TV License Authority to the banks. Valuations needs to be obtained for every asset, such as a property, bank account or shareholding, and every debt, such as a mortgage or car loan.

- The valuations will then be used to calculate whether the estate is liable for inheritance tax and where appropriate, an inheritance tax return might need to be filed with HM Revenue & Customs. Inheritance tax must usually be paid within 6 months of the month of death. It may be possible to pay part of the liability by instalments although this will attract interest.

- After the inheritance tax position has been resolved, you can then apply to the Probate Registry, a division of the Court, for Probate. Be patient as it can take make months for Probate to be granted.

- Once the Court has issued the Probate, you can then use it to cash in the estate assets, pay any debts and make a distribution of the balance to beneficiaries.

Top tip – keep a track of any income the estate generates as it may trigger the requirement to file an income tax return for the estate. For example, interest received on cash and investments might have to be declared to HMRC with the appropriate income tax. Likewise, if assets are sold for a profit, for example a property sells for more than its value at the date of death, it may trigger a capital gains tax liability. If in doubt seek help from an expert probate lawyer who can guide you through the process.

Distribution

13. Once the Court has issued the Probate, you can start administering the estate in accordance with the Will (if there is one) or the default rules which apply where there is no Will (known as the intestacy rules).

14. Debts must always be paid before a distribution can be paid. This could include household utility bills, mortgages, loans or unpaid taxes. Reimbursement of reasonable expenses of dealing with the administration must also be paid before there is a distribution.

15. Specific gifts mentioned in a Will should be the first payments or transfers made. For example, if a Will left a set cash gift of £1,000 to a grandchild, this would need to be paid as a priority beneficiary before the balance (known as the ‘Residue’) is distributed.

16. The remainder would then need to be distributed between any beneficiaries (if relevant).

17. If the deceased’s property is to be sold, it can now be placed on the market and estate agents can be instructed.

Top tip – if there is a property to sell, you are free to market it before you obtain Probate. You will not be able to commit to the sale by exchanging contracts and transferring the title, but the time period whilst you wait for the Court to issue Probate can be used for marketing and viewings. Even where a buyer is found relatively quickly, the property sale process (known as conveyancing) typically takes in the region of 12 weeks so by starting the marketing at the same point that Probate is applied for you can save valuable time. Just remember to let potential buyers know.

Manzurul Islam, Head of Wills & Probate at Mullis & Peake, said:

“Most people seek expert assistance from a probate lawyer to help with the administration of an estate. Your probate lawyer can do as much as little as you need them to. Often people like to hand the entire process over to a lawyer for complete peace of mind.

However, you could ask your lawyer to only deal with the more technical elements, such as preparing the inheritance tax returns and the Court application for probate, leaving you to handle the more routine day-to-day administration such as obtaining the valuations and collecting the cash. By sharing the burden you can significantly reduce the costs to the estate, leaving more to share amongst the intended beneficiaries. This might be a more suitable and cost effective option for more simple and modest estates.”